Don’t Let Financing Hold you Back

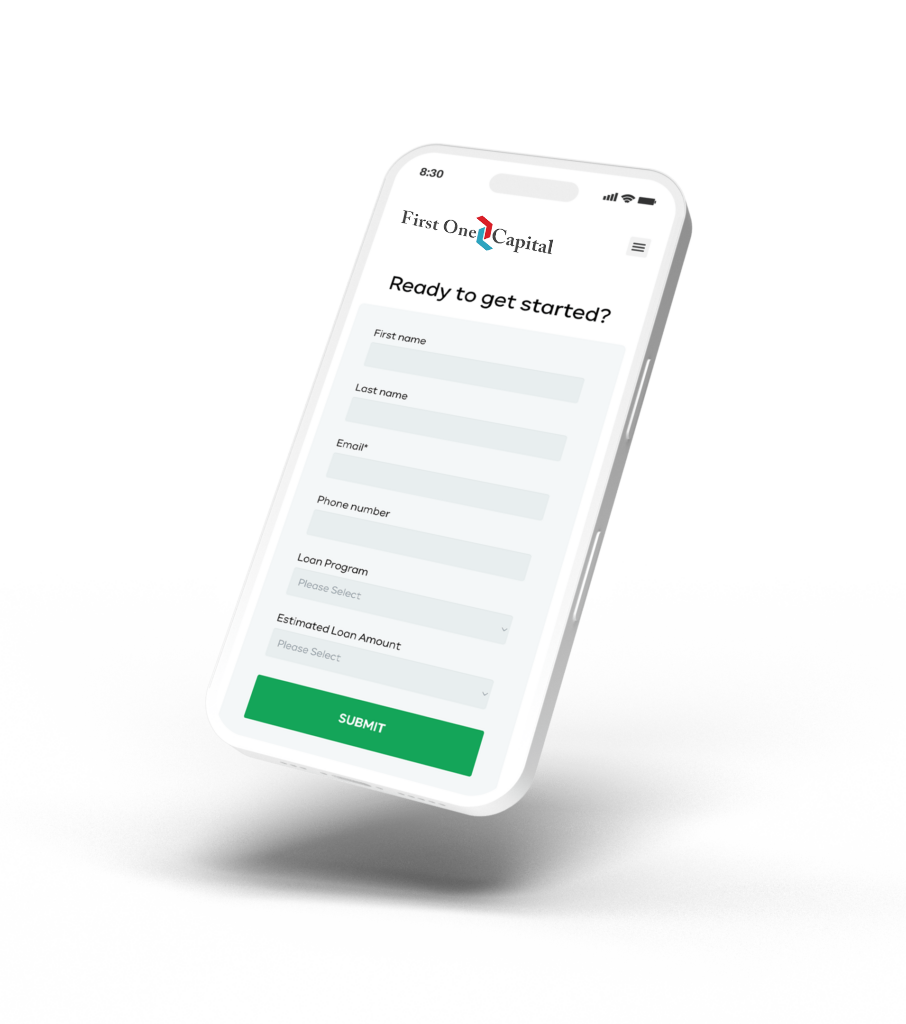

As a business owner, you know that securing financing can be a challenging and time-consuming process. That’s why LoanBud is here to make it easier for you. We understand small business owners’ unique needs and challenges and are committed to helping you achieve your goals. We have the perfect solution for your cash flow needs with our range of financing options, including accounts receivable factoring, lines of credit, merchant cash advances, and term loans. In addition, our streamlined application process and quick turnaround time mean you can get the funding you need in as little as 24 hours. Let us help you take your business to the next level.